From the beginning of 2020, the complicated situation of COVID-19 has significantly affected the economy, having severe impacts on many aspects of life, society and the ability to implement annual socio-economic goals, targets and tasks and in 5-year period 2021-2025. On 30 January 2022, Resolution No.11 was promulgated by the Government with the goal of recovering production and business activities of enterprises, economic organizations while promoting growth activities, with a view to stabilizing the economy and ensuring social security for people.

At the same time, to ensure that enterprises and people will soon benefit from exemption, reduction of tax and charges policies, facilitating invoice issuance, tax declarations & submission and united implementation across the country, after National Assembly ratified Resolution No.43/2022/QH15, Ministry of Finance has urgently researched, developed and submitted to the Government for promulgation of Decree No. 15/2022/ND-CP dated 28 January 2022 regulating tax exemption and reduction policies according to Resolution No. 43/2022/QH15.

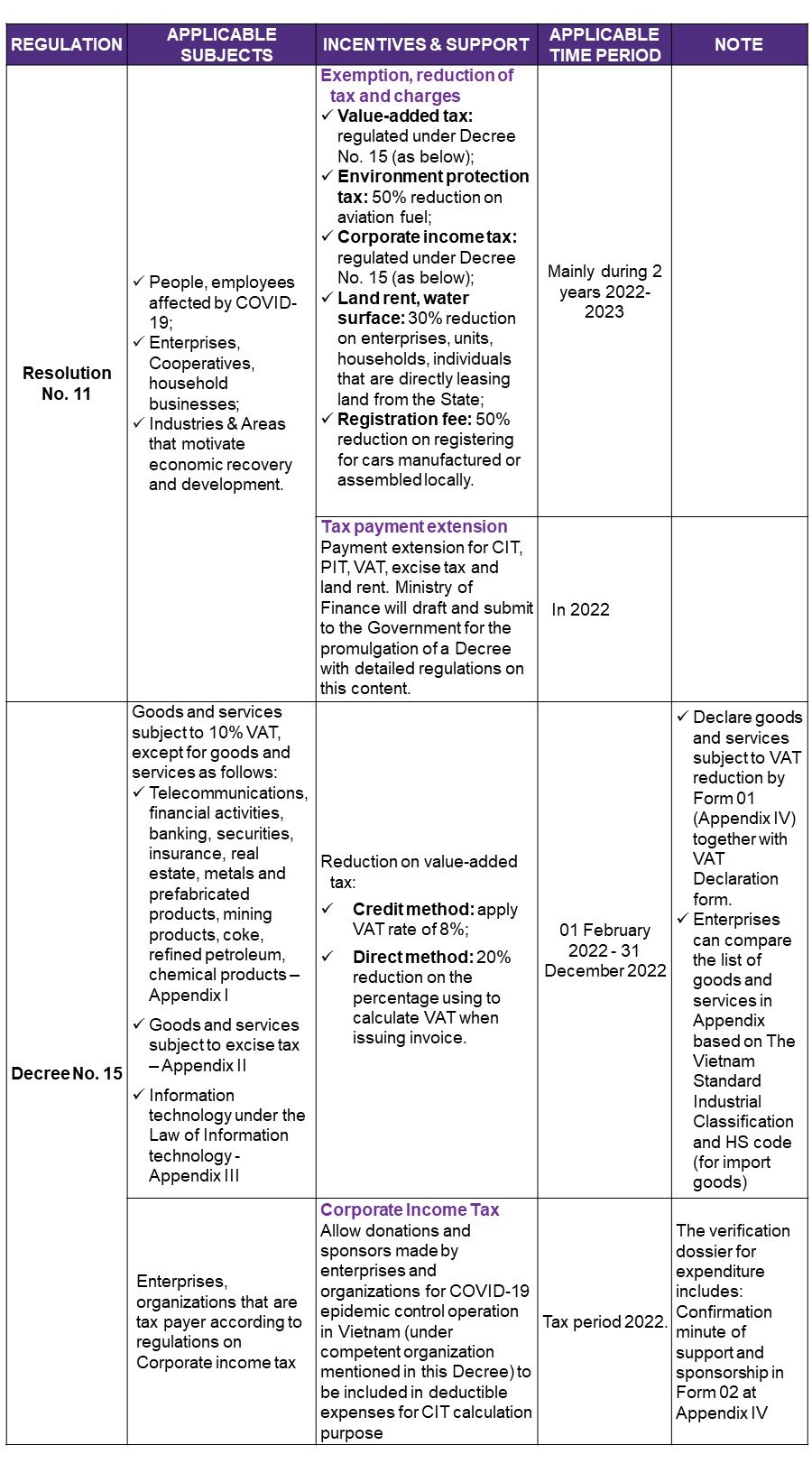

In this newsletter, Grant Thornton Vietnam would like to update to some notable contents of Resolution No.11 about the socio-economic recovery and development program and Decree No.15 about tax exemption and reduction policies as follows:

The enterprises should carefully review the policies and conditions to enjoy the incentives in accordance with regulations. Please contact the experts at Grant Thornton Vietnam for in-depth advice should you have any questions during the review, assessment, planning and implementation process of the above-mentioned tax incentives.